For Deposit Only

Answer by Brian Crow: If your state has adopted the model language of the Uniform Commercial Code, Article 3-204 defines an endorsement as a 'signature.' Therefore the words 'for deposit only' in the absence of the payee's signature or endorsement stamp would not constitute an endorsement.

However, the depository bank does not need to require an endorsement (except on insurance drafts that will be returned without the endorsement of all payees) as the depository bank guarantees that the payee received benefit from the funds by the presentment warranties that is makes under Article 4-208.

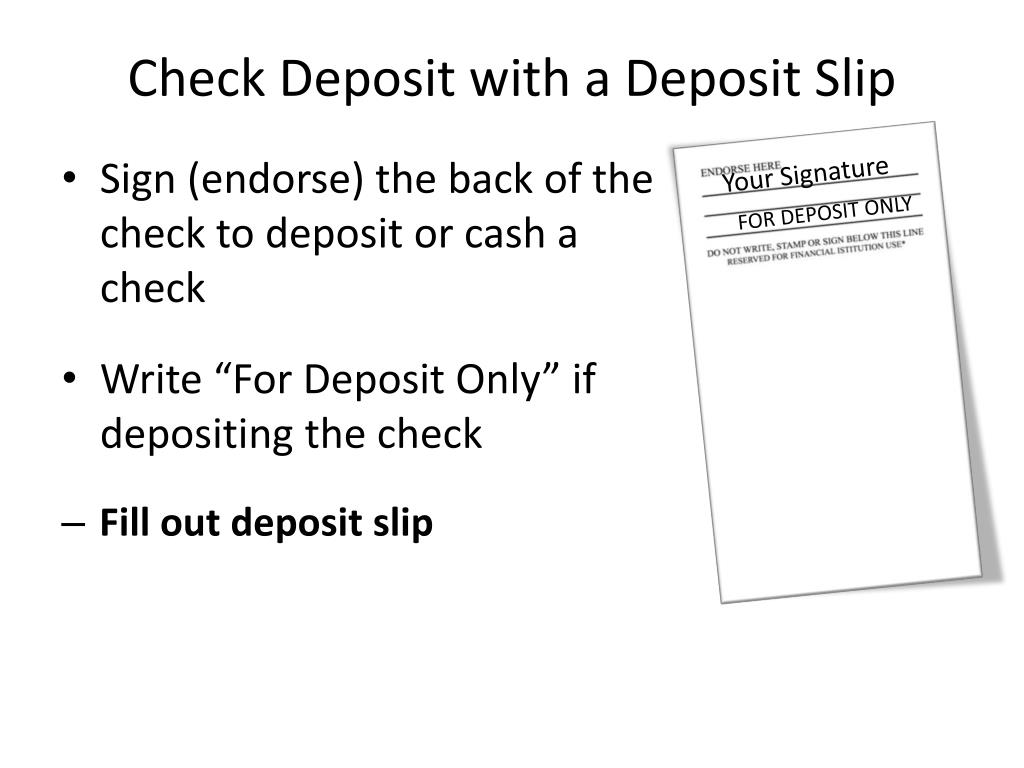

For Deposit Only Bank Stamps

For example, if you’re mailing the check because you want to deposit it to another account, you might write, “For deposit only' and then write your account number. 1 That way, no one else can cash the check if it’s lost in the mail. Is a Signature Required on the Back of a Check? An endorsement which purports to require that the funds be applied in a certain manner (e.g. 'for deposit only', 'for collection') is a restrictive endorsement; and, An endorsement purporting to disclaim retroactive liability is called a qualified endorsement (through the inscription of the words 'without recourse' as part of the endorsement on.

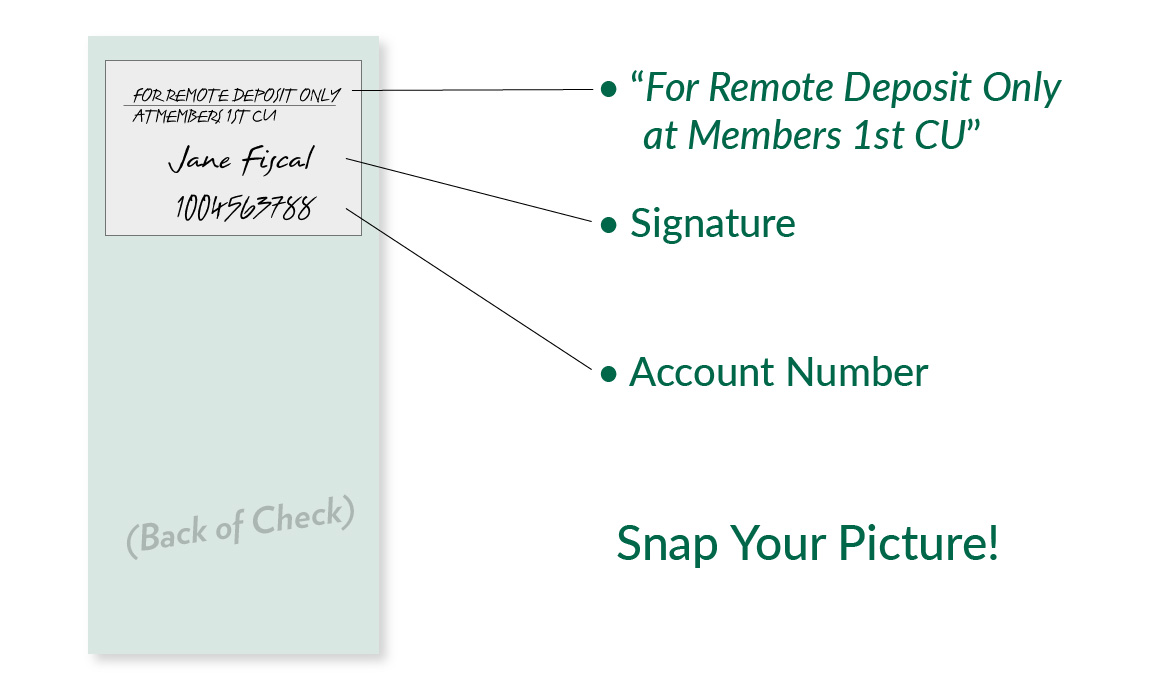

- Write: “For Deposit Only to Account Number XXXXXXXXXX” Sign your name below that, but still within the endorsement area of the check This method specifically instructs the bank that the check should be deposited into the account identified in the endorsement.

- For example, if you deposit a $2,500 check through Mobile Deposits on Monday and receive deposit approval before 6 pm, ET on Monday, $225 of the deposit will be available that day for cash withdrawal only. The remaining $2,275 will be available on Wednesday (2 business days after the approval).

Answer by Ken Golliher: Said differently, 'For Deposit Only' is a restriction on an endorsement, not a signature. If yours is the bank of first deposit, you guarantee any missing signature.

You could accept the item. You could also reject it.

If you are the paying bank, you already have the bank of first deposit's guarantee of the missing signature; there is no logic behind a decision to return the item so they can whack it with a rubber stamp that guarantees the missing endorsement again.

First published on BankersOnline.com 6/25/12

What is the For Deposit Only Endorsement?

The 'for deposit only' endorsement is added to the back of a check in order to restrict the payment of the check to the endorser. An even more restrictive endorsement is to write the name of the account number into which the funds are to be deposited, such as 'for deposit only to account 1234-123,' which requires the funds to be deposited into the specified account. Writing this type of wording onto the back of a check ensures that funds cannot be diverted elsewhere. For example, if a person were to just sign her name in the endorsement block on the back of a check, the check is still considered a bearer instrument, which means that anyone having possession of the check can cash it.

It is most important to use the 'for deposit only' endorsement when a check will be out of the physical control of the payee for a period of time, such as when the check is being mailed to a bank for deposit. Conversely, if the payee is hand-carrying the check to a bank, there is less need to use this restrictive endorsement.

For Deposit Only On Check

Related Courses

For Deposit Only Stamper

Corporate Cash Management

Treasurer's Guidebook